Why You Want To Use Fib's Levels

Fibonacci retracement levels are used as part of a trend trading strategy. We observe a retracement taking place within a trend & make low-risk entries in the direction of the initial trend using Fibonacci levels.

Fibonacci Levels create a high probability trade setup when used with other indicators like EMA crossovers and lower indicators like the squeeze and volume.

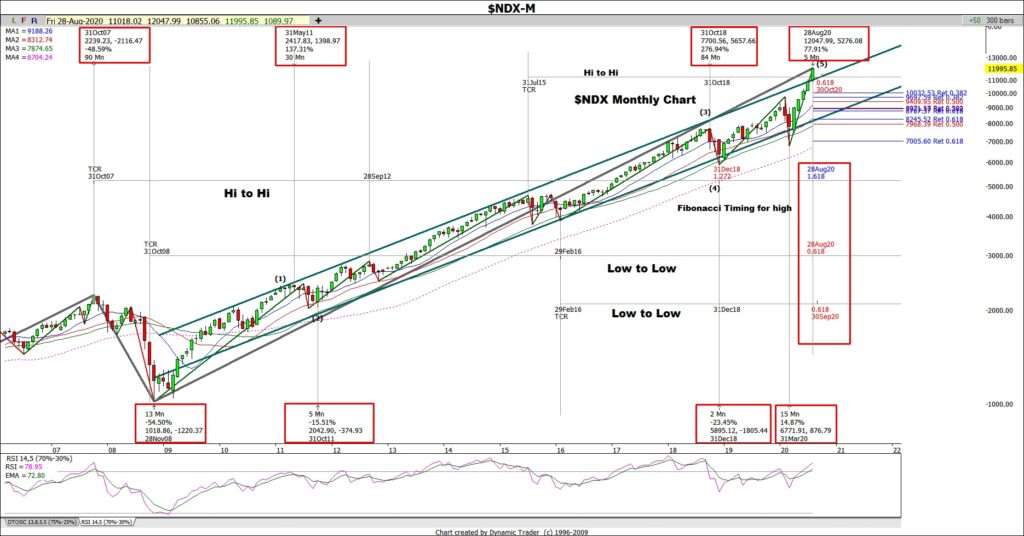

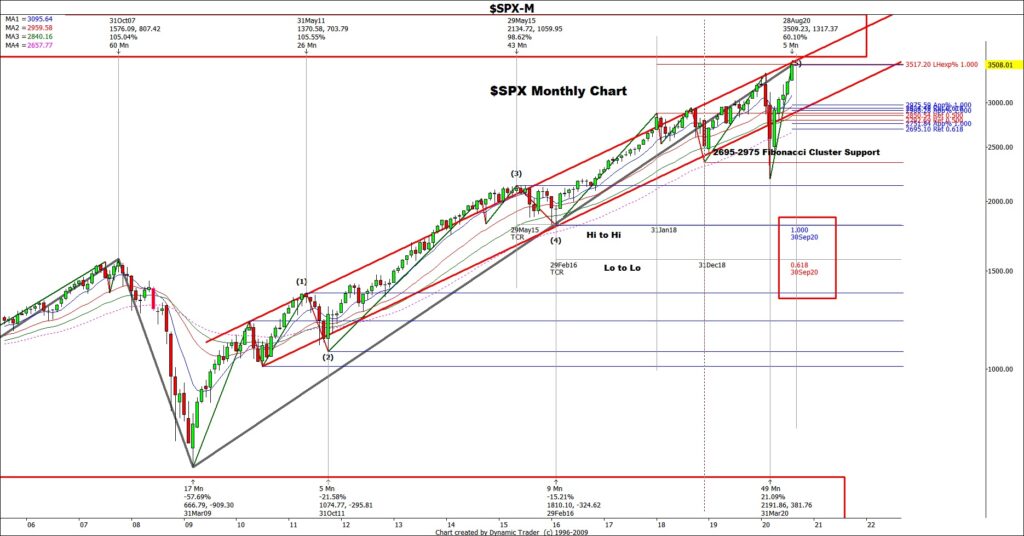

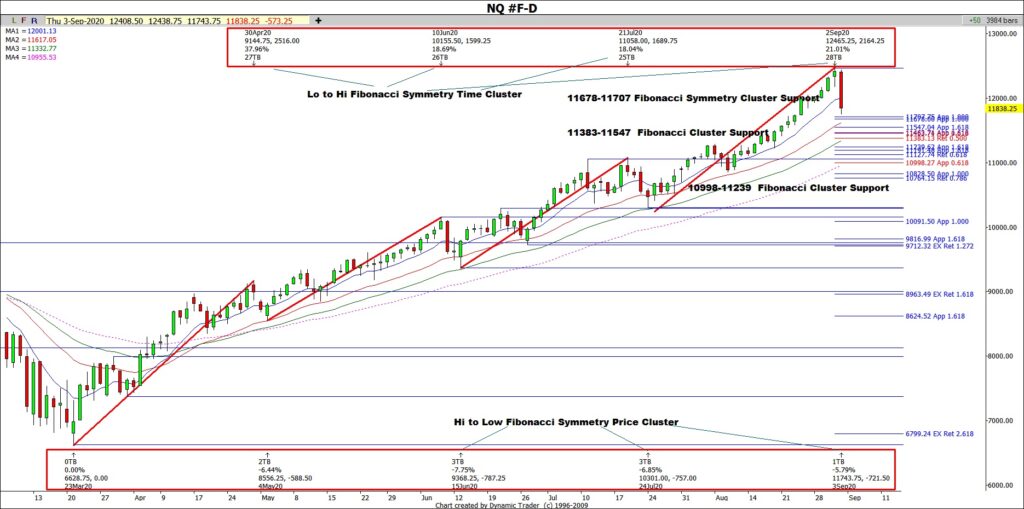

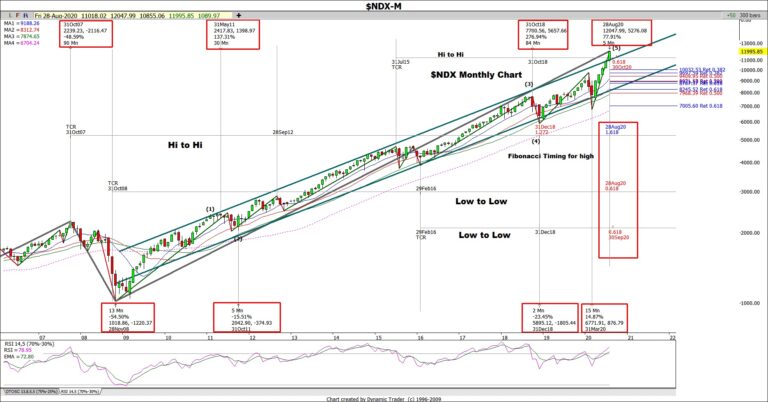

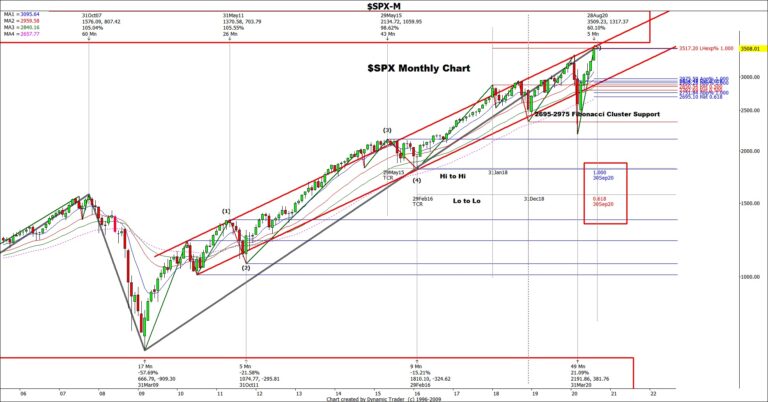

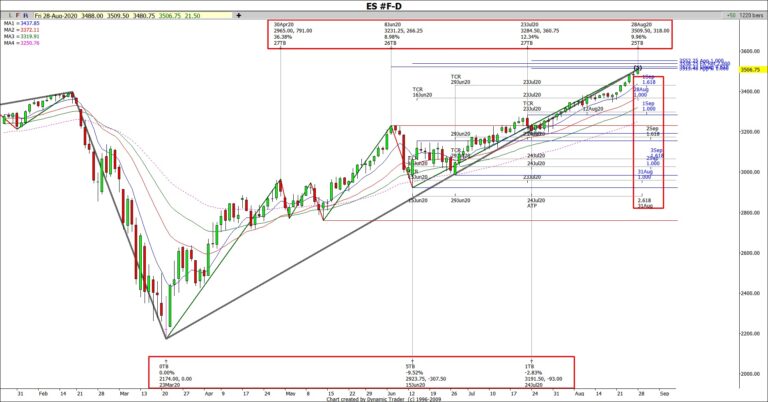

We will do an in-depth Fibonacci Timing & Price Analysis in the chat room for stocks, futures assets & ETFs to identify potential support & resistance in the future based on past price trends & reversals using Dynamic Traders software. We will also be using Elliot Wave Theory to predict Price Movements by identifying repeating waveform patterns using E-Signal Advanced Get Tools. I also focus on technical indicators like RSI, Moving Average Crossovers and Squeeze.

Finally, our philosophy is that success takes patience and little victories are important. We don’t necessarily have to hit a home run on our first go; in fact, aiming to always hit a home run will often lead you to getting out. Similarly, stocks is not a go big or go home game. A series of singles or doubles will also add up over time and let you win the game. Every now and then we will hit a home run. However, it shouldn’t be our primary motive.